Airlines Stocks Look Awful While Stock Market Risk Clearly Defined

Yesterday, I wrote about my anger and disgust regarding the airline bailout. That won’t change anytime soon. Today, I want to look at the group and how they have been trading. Below you can see a chart of the airlines as represented by the JETS ETF. Besides declining 65% from high to low since the market’s peak, notice how little green is on the chart. Green days mean the closing price is that much higher than the opening price. Red means the opposite, the close was lower than the open.

Red days show that emotion ruled the opening but smarter minds prevailed by the close as the airlines closed lower since the open. That’s typically a sign of moving exiting a sector. Even since the bottom last month, we have only two green days, not exactly the pillar of strength.

Moreover, for all those hanging your hat on the notion that a government bailout will mean great things for the stock, think again. While a bailout might avoid Chapter 11 where many of them belong, I will argue that it will prevent the airlines from recovering anytime soon and perhaps not even by 2025 or 2030. Those that could survive should do so without aid and those that can’t should take advantage of the bankruptcy laws and file to reorganize without the debt overhang.

Finally for this update, I want to show you two charts below that I posted on Twitter yesterday. The first one shows the number of stocks going up on all days since the March 23 bottom. On most up days, we see 2000 stocks advancing, an extreme number.

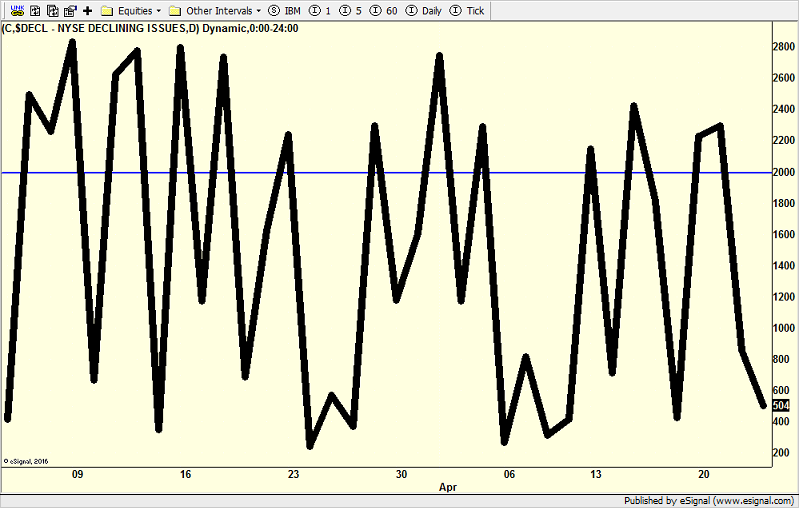

Below is the opposite chart, stocks going down every day since early March. On down market days, we usually see at least 2000 stocks going down. In other words, the stock market has become an all or none proposition as the computer driven algorithms have completely dominated.

On Wednesday I concluded with my thought that the bulls were supposed to come back to work after a two-day, 1000 point decline. They did a nice job. Over the coming days the bulls need to keep going and close above last week’s high which is 24,300 in the Dow and 2880 in the S&P 500. Without doing that, there is downside risk to 22,500 and 2640 respectively.

Stay safe and healthy!

See you next week…